So, what exactly is risk mitigation planning?

At its core, it's the process of putting together a game plan to spot, evaluate, and soften the blow of anything that could threaten your business or a project. Think of it like drawing up a fire escape plan for your office before you ever smell a whiff of smoke. It’s all about being proactive, so small hiccups don’t have a chance to turn into full-blown catastrophes.

Why Your Business Needs a Playbook for the Unexpected

Let's be real—running a business can feel like steering a ship through a storm. You might have the sturdiest vessel and the best crew, but a sudden squall can still appear out of nowhere. A solid risk mitigation plan is your nautical chart and compass, helping you see those storms coming and chart a course to get through them safely.

This is about moving from a reactive, fire-fighting posture to a proactive, strategic one. Instead of getting caught flat-footed when things go sideways, you have a clear, pre-planned approach to handle it. The goal isn't to eliminate every single risk on the planet—that's impossible. It's about building resilience so your business can take a punch and keep moving forward.

From Theory to Tangible Benefits

A good risk mitigation plan isn't just about peace of mind; it brings real, measurable advantages that protect your operations and your wallet. When you take the time to formalize this process, you start seeing some serious benefits:

- Better Project Outcomes: Research consistently shows that projects with formal risk planning are far more likely to stick to their budget and hit their deadlines. When you tackle potential roadblocks early on, you prevent those costly delays and scope changes later.

- Smarter Decision-Making: When leaders have a clear picture of potential threats and how bad they could be, they can make decisions with more confidence. You’re no longer operating on guesswork; you’re guided by actual analysis.

- Stronger Stakeholder Confidence: Investors, customers, and even your own team have more faith in a company that’s prepared. Showing that you're serious about managing risks proves you’re stable and forward-thinking, which does wonders for your reputation.

- Fewer Financial Shocks: Surprise problems usually come with surprise bills. A mitigation plan can slash those financial hits, whether it’s by shifting risk through insurance or putting controls in place to limit the damage from the get-go.

A strong mitigation plan is all about getting ahead of potential risks before they spiral into major problems. It takes uncertainty from being a source of stress and turns it into just another manageable part of doing business.

More Than Just a Document

At the end of the day, a risk mitigation plan is a living guide, not some binder meant to collect dust on a shelf. It should weave its way into your strategic thinking, shaping everything from your daily routines to your biggest long-term goals.

It also helps build a culture where everyone feels comfortable pointing out potential issues and pitching in on solutions. That kind of collective awareness is incredibly powerful. When everyone, from the front-line staff to the CEO, is thinking about risk, your entire organization naturally becomes tougher and more agile.

It’s like installing smoke detectors, fire extinguishers, and a sprinkler system. You hope you’ll never have to use them, but knowing they’re there lets you run your business with confidence, ready for whatever comes your way.

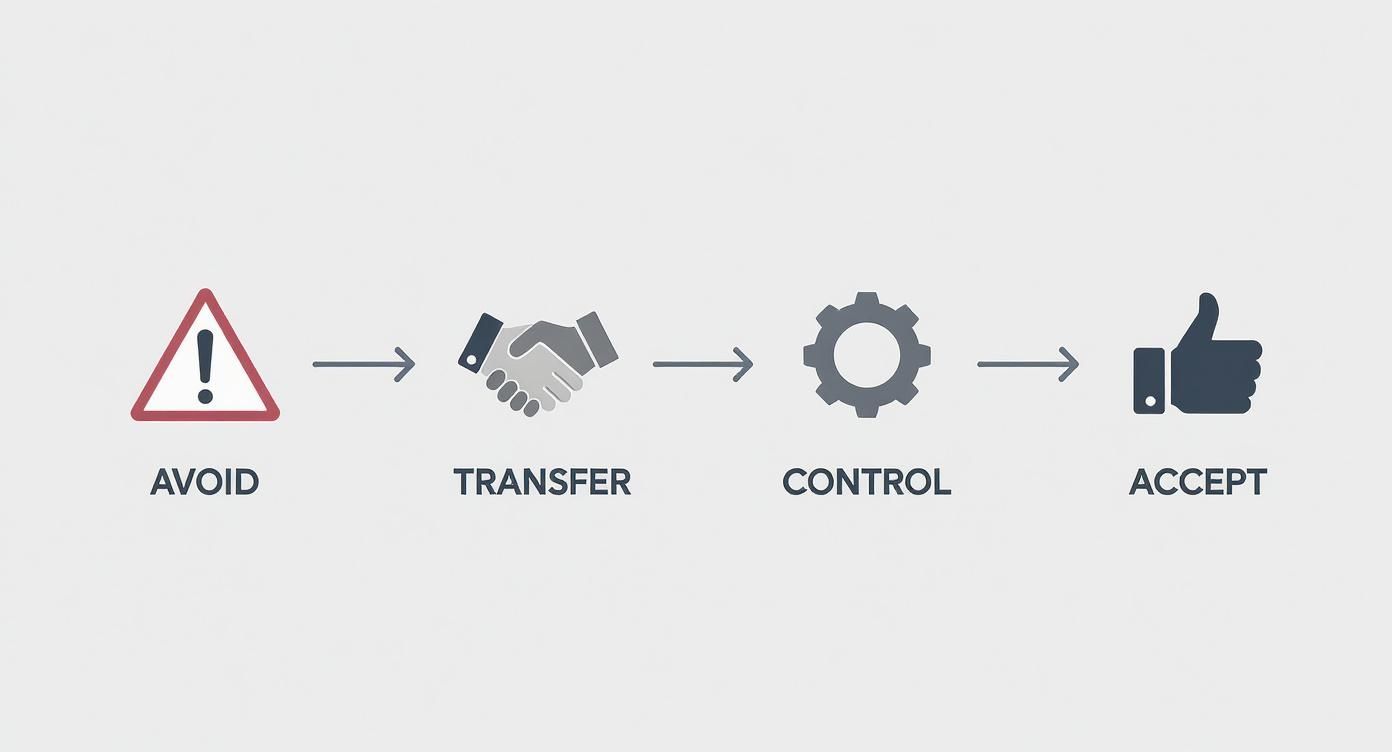

The Four Core Risk Response Strategies

So, you’ve spotted a risk. Now what? When you get down to it, you really only have four main ways to respond. Getting a handle on these options is the heart and soul of solid risk mitigation planning. It’s how you turn those "what if" worries into a clear plan of action.

Think of it like you're on a road trip and see a problem ahead. Your next move depends entirely on what you're facing. Is it a small pothole you can just drive over, or is the entire bridge out? Each situation calls for a different play.

Strategy 1: Avoid the Risk

Risk avoidance is the most straightforward move: you sidestep the threat completely by not doing the thing that causes it in the first place. On that road trip, it’s like seeing a monster traffic jam on your GPS and deciding to take a totally different—even if longer—route. Problem solved, because you never even went near it.

For a business, this might look like turning down a project that’s all risk and little reward, or deciding against expanding into a market that's just too unpredictable. The idea is to stop the risk from ever becoming a reality.

The name of the game with risk avoidance is total prevention. When a risk could lead to a catastrophic, truly unacceptable outcome, the smartest play is to just stay away.

This is a powerful strategy, but it’s not without its downside. By avoiding the risk, you also walk away from any potential upside or reward that came with it. That’s why it's best saved for those high-impact, high-probability threats where the potential damage is just too big to mess with.

Strategy 2: Accept the Risk

Sometimes, the cure is worse than the disease. In other words, the cost and effort to fight a risk are way more than the damage it could possibly cause. That's when you choose to accept the risk. You see it, you acknowledge it, but you decide to do nothing and just deal with the consequences if it happens.

This is like deciding to drive through that rush-hour traffic anyway. You know you’ll be delayed, but the detour is an hour out of your way, and a few minutes of traffic is a price you're willing to pay.

A company might accept the risk of a keyboard or mouse breaking. It's bound to happen, but keeping a full-time IT tech on staff just for that would be overkill. It’s cheaper to just buy a new one when it breaks. This approach is perfect for low-impact risks where trying to mitigate them just isn't worth the hassle.

Strategy 3: Transfer the Risk

With risk transfer, you’re basically handing off the financial consequences of a risk to someone else. The classic example is insurance. You pay your car insurance company a premium every month so that if you get in a wreck, they’re the ones on the hook for the massive repair bills, not you.

In the business world, this happens all the time through:

- Insurance Policies: Covering everything from fires and floods to professional liability.

- Outsourcing: Hiring a specialized firm for a tricky function like cybersecurity. You're paying them to take on the operational risk of getting it right.

- Contracts: Using warranties and indemnity clauses to make a supplier financially responsible if their part fails.

This strategy doesn't make the risk disappear, but it moves the financial headache from your books to someone else's. It's a foundational piece of any good risk mitigation plan.

Strategy 4: Control the Risk

This is the one you’ll probably use most often. Risk control (also called risk reduction or mitigation) is all about taking active steps to make a risk less likely to happen or less damaging if it does. It's your hands-on, proactive strategy.

Think about basic car maintenance, like getting regular oil changes and rotating your tires. You can't guarantee you'll never have a breakdown, but you're drastically lowering the odds.

Businesses do this constantly. Installing fire sprinklers, running safety training for employees, requiring strong passwords, or using multiple suppliers so you’re not dependent on just one—these are all risk control measures.

This proactive mindset is becoming the norm. A recent survey showed that 78% of organizations now have a formal plan to tackle their biggest global risks, which is a big jump from just 65% a few years ago. You can dig into the full findings on why this trend is accelerating.

To make it even clearer, let's break down how these four strategies stack up against each other.

Comparing The Four Risk Mitigation Strategies

| Strategy | What It Means | Best Used When | Simple Example |

|---|---|---|---|

| Avoid | Completely sidestep the activity that creates the risk. | The potential impact is catastrophic and the risk is highly probable. | A pharmaceutical company halts a clinical trial after discovering severe side effects. |

| Accept | Acknowledge the risk but take no action to reduce it. | The potential impact is low and the cost of mitigation is too high. | A retail store accepts the small risk of minor shoplifting without installing a costly security system. |

| Transfer | Shift the financial consequences of the risk to a third party. | The risk can be covered by insurance or handled more effectively by an outside party. | A construction company buys liability insurance to cover potential on-site accidents. |

| Control | Implement measures to reduce the likelihood or impact of the risk. | The risk cannot be avoided, but its potential damage can be lessened. | An IT department enforces multi-factor authentication to reduce the likelihood of a data breach. |

Ultimately, choosing the right strategy is all about context. By understanding these four options, you can move from simply worrying about what could go wrong to making smart, strategic decisions that protect your goals.

How to Build Your Risk Mitigation Plan Step by Step

Alright, theory is great, but let's get our hands dirty and actually build this thing. Putting together a risk mitigation plan can feel like a huge project, but it’s really just a series of logical steps. Think of it less like writing a legal document and more like putting together IKEA furniture—just follow the instructions, and you'll end up with something solid.

This step-by-step process breaks it all down into manageable chunks. We'll go from brainstorming what could go wrong to creating a living document that makes your business stronger.

Step 1: Identify Potential Risks

You can’t fix a problem you don’t know exists. The absolute first step is to get a handle on everything that could possibly go wrong. This isn't about being a pessimist; it’s about being prepared.

The best way to kick this off is by getting the right people in a room together. Seriously, don't try to do this alone. Grab team members from different corners of the business—logistics, finance, IT, sales, you name it. Each person brings a totally unique perspective and will spot threats others would miss. Your logistics manager is going to see supply chain nightmares, while your IT specialist is thinking about the latest cybersecurity threat.

At this stage, there are no bad ideas. Just create one master list of every single risk you can think of, big or small. Don't even worry about ranking them yet. The goal here is just to get everything out on the table.

Step 2: Analyze and Prioritize Your Risks

Now that you have a giant list of potential doom, it's time to figure out which ones are actually worth losing sleep over. Let's be real: not all risks are created equal. The risk of the office running out of coffee doesn't quite stack up against a massive data breach.

To sort through the noise, use a simple but super effective tool called a risk matrix. It’s just a way of grading each risk on two critical factors:

- Likelihood: How likely is this thing to actually happen? You can rate it simply as Low, Medium, or High.

- Impact: If it does happen, how bad will the fallout be? Again, think Low, Medium, or High.

Any risk that scores High on both likelihood and impact shoots straight to the top of your priority list. Something with low likelihood and low impact? You can probably bump that to the bottom for now. This little exercise instantly brings clarity to the chaos, showing you exactly where to focus your time and money.

A risk matrix isn't a crystal ball. Its job is to bring order to chaos and give you a clear, data-informed pecking order for tackling the biggest threats first.

Step 3: Develop Mitigation Strategies

This is where the real planning happens. For each of your high-priority risks, you need to decide on a game plan. This is where you put those four core strategies to work: Avoid, Accept, Transfer, or Control.

Your response has to fit the risk. You’ll likely end up using a mix of strategies for different types of threats.

This diagram lays out the four fundamental strategies you can use when you're building out your plan.

As the visual shows, your choice—whether to sidestep a risk, hand it off to someone else, shrink its impact, or just live with it—is a strategic call based on what’s at stake.

As you build out your plan, weaving in operational risk management best practices is a game-changer. These practices give you a solid framework to make sure your efforts are robust and actually become part of your day-to-day operations.

Step 4: Implement the Plan

A plan is just a piece of paper until you actually do something with it. This step is all about execution. For every strategy you’ve mapped out, you need to define clear, actionable steps.

And most importantly, you need to assign ownership. Every single risk needs a designated risk owner. This is the one person responsible for keeping an eye on that risk and kicking the mitigation plan into gear if things go south. When everyone knows who's in charge of what, there's no frantic finger-pointing when a crisis hits.

This stage is also where you'll nail down the details:

- Timelines: When do these actions need to be done by?

- Resources: What budget, tools, or people do we need?

- Success Metrics: How will we know if our plan is actually working?

Step 5: Monitor and Review Your Plan

Finally, remember that risk mitigation is not a "set it and forget it" task. Your business is always changing, new risks are always popping up, and old ones fade away. Your plan needs to be a living document that evolves right along with you.

Schedule regular check-ins to review your risk plan. A quarterly review is a great place to start for most companies. During these meetings, you should be asking some tough questions:

- Are our current strategies still working?

- Are there any new threats on the horizon we missed?

- Have the priorities of our existing risks changed?

- Has the person responsible for a risk moved to a new role?

This constant cycle of monitoring and updating is what keeps your plan relevant and effective. It ensures you’re protected not just from today’s problems, but from whatever tomorrow throws at you, too.

Tools and Frameworks That Make Planning Easier

Staring at a blank page when you're supposed to be planning for risks can feel pretty daunting. But here's the thing: you don't have to reinvent the wheel. Experts use a handful of tried-and-true tools and frameworks to give the process some much-needed structure, turning a massive headache into a set of clear, manageable steps.

These aren't overly complex systems. Think of them as the essential gear for an expedition—your compass, map, and logbook. They’re designed to help you organize your thoughts, see how things connect, and keep track of everything so you don’t get lost.

The Essential Risk Register

The absolute cornerstone of any good plan is the Risk Register. At its core, it's just a master list—usually a spreadsheet or a feature in a project management tool—where you document every single risk you’ve identified. It becomes your single source of truth for all things risk-related.

A decent risk register does more than just name the risk. For every potential issue, you should be tracking a few key details:

- Risk Description: A quick, clear sentence on what could go wrong.

- Impact and Likelihood: The scores you gave it during your analysis.

- Risk Owner: Who’s on point for watching and dealing with this risk?

- Mitigation Strategy: What’s the game plan to handle it?

- Status: A simple tracker (like Open, In Progress, Closed) to show where things stand at a glance.

This simple document is what turns vague worries into concrete, trackable tasks. Keeping it up to date is non-negotiable for effective risk mitigation planning, as it gives everyone a clear snapshot of the situation.

Uncovering Risks with a SWOT Analysis

Sometimes the biggest threats are hiding right under your nose. The classic SWOT Analysis (Strengths, Weaknesses, Opportunities, Threats) is a fantastic way to dig them up. People often use it for high-level business strategy, but it’s surprisingly good for pinpointing risks.

Your internal Weaknesses and external Threats are basically a goldmine for potential risks. For example, a weakness like "outdated tech stack" is a direct pointer to cybersecurity vulnerabilities. A threat like "a new competitor just launched" flags a clear financial and operational risk.

Using a SWOT forces you to look at your business from all sides, and you’ll often spot risks that a simple brainstorming session would have missed. It helps tie your risk planning directly back to your bigger strategic goals.

Visualizing Connections with a Bowtie Analysis

When you’re dealing with more complex, multi-layered risks, the Bowtie Analysis is an incredibly powerful way to visualize them. It’s named for its shape, which looks exactly like a bowtie. Right in the middle, you put the main risk event—say, "Server Outage."

On the left side of the "knot," you list all the things that could cause that event. On the right, you list all the possible consequences. Then, you start filling in the gaps: on the left, you map out your preventive measures (to stop the causes), and on the right, you map out your recovery controls (to soften the blow of the consequences).

This method gives you a complete picture of a risk's entire lifecycle on one page. It makes it dead simple to see how causes, controls, and consequences are all linked, showing you where you’re strong and where you need to bulk up your defenses. That kind of visual clarity is also amazing for getting your team on the same page.

Integrating Risk into Your Daily Workflow

Your risk plan is useless if it’s buried in a folder no one ever opens. The best way to make it work is to weave it directly into the tools your team already uses every single day. Modern project management platforms like Asana, Jira, or Trello are perfect for this.

You can create specific tasks for each risk, assign them to the risk owner, and set due dates for the mitigation steps. It’s also where you can integrate specialized tools that handle specific risks, like adding Stripe Chargeback Protection to manage transaction fraud. This approach turns risk management from a boring administrative chore into an active, ongoing part of your normal workflow.

When you bake risk mitigation planning into your core strategies, the results speak for themselves. One report found that countries with solid risk frameworks saw 25% fewer disaster-related deaths and 35% lower economic losses compared to those without them. The data doesn't lie.

Real-World Examples of Risk Mitigation Done Right

Theory is great, but seeing risk mitigation in action is what makes it all click. Let's look at a few stories from different industries to see how smart planning can turn a potential disaster into just another Tuesday.

Getting this right has never been more critical. When you add up all the ripple effects, disaster-related costs now top $2.3 trillion globally each year. But here’s the upside: every single dollar spent on proactive planning can save up to $7 in recovery costs down the road. You can dig into the numbers yourself in the full GAR 2025 report to see just how massive the financial benefit of being prepared is.

The Tech Startup and the Server Crash

Picture a hot tech startup, growing like a weed. What’s their worst nightmare? A total server meltdown that knocks their app offline for hours—or worse, days. That’s not just an inconvenience; it’s a potential company-killer that would vaporize user trust and revenue.

Their risk mitigation plan is a brilliant two-punch combo:

- Risk Transfer: Instead of trying to manage their own server farm, they host everything on a major cloud provider like Amazon Web Services (AWS). Just like that, they’ve transferred the enormous risk of hardware failure, power outages, and physical security to a company that lives and breathes that stuff.

- Risk Control: But they don't stop there. To control the risk of data loss from a nasty bug or a cyberattack, they set up automated, daily backups of all their crucial data. If the worst happens, they can just roll back to a clean version from yesterday with minimal downtime.

By blending these two strategies, a potential catastrophe becomes a minor hiccup that’s fixed in a flash.

The Construction Firm and Material Delays

On a construction site, the schedule is sacred. One of the biggest risks is a delay in getting critical building materials, which can bring the entire project to a screeching halt and trigger massive financial penalties. A well-run firm bakes a mitigation plan right into their project management from day one.

Their strategy is all about acceptance and control:

- Risk Acceptance: They’re realistic. They know small delays are part of the game. So, they accept this risk by building a calculated time buffer directly into the project schedule. A minor snag doesn’t cause a full-blown panic.

- Risk Control: To dodge a major delay, they get smart about their supply chain. Instead of putting all their eggs in one basket, they pre-order key materials from several different suppliers in different locations. If one vendor has a problem, they have backups ready to roll.

By accepting the small stuff and actively controlling the big stuff, the construction firm keeps the project on track, protecting both its timeline and its bottom line.

Of course, when a risk actually becomes a reality, you need a solid communication strategy. For more on that, take a look at our guide on how to build a crisis communication plan to make sure everyone stays in the loop.

The Event Organizer and Bad Weather

An outdoor music festival is the perfect storm of risk—literally. A sudden downpour can completely wash out the event, leading to angry refund demands and a PR nightmare.

An experienced event organizer handles this by transferring the problem. They secure a backup indoor venue well in advance. Sure, it adds a bit to the upfront cost, but it completely neutralizes the threat of bad weather. If the forecast looks ugly, they just pivot to the indoor location.

What could have been an event-canceling disaster becomes a simple, manageable change of plans. That's risk mitigation in a nutshell.

Common Mistakes in Risk Planning and How to Avoid Them

Even the most well-intentioned risk mitigation plan can go wrong if you fall into a few common traps. Just building the plan is a huge win, but keeping it effective means you have to sidestep the pitfalls that can make it totally useless when you actually need it.

Let's walk through the mistakes I see teams make all the time, and more importantly, how you can avoid them.

The biggest one? The "set it and forget it" mentality. A team will spend weeks crafting a beautiful, detailed document, only to let it gather dust in a shared drive. Risks change, and so should your plan. Think of it as a living document, not a one-and-done project.

The Pitfall of Vague Planning

Another classic error is making a plan that’s just too vague to be useful. I've seen risk plans filled with generic statements like "improve cybersecurity" or "monitor supply chain." That’s not a plan—it's a wish list. When push comes to shove, nobody knows what to actually do.

The fix is simple: get specific. Every single mitigation strategy needs clear, actionable steps. Instead of "improve cybersecurity," break it down. Think: "implement multi-factor authentication for all employees by Q3" or "conduct quarterly phishing simulations." Specificity is what turns a vague goal into a real to-do list.

A risk mitigation plan fails when accountability is unclear. If a risk is everyone's responsibility, it quickly becomes no one's responsibility. Every single identified risk must have a designated owner.

This person is the go-to for tracking the risk and pulling the trigger on the response plan. When ownership is crystal clear, there’s no confusion or finger-pointing when a crisis hits.

Mismanaging Risk Ownership

Speaking of which, failing to assign clear owners for each risk is a recipe for disaster. When a threat pops up, the last thing you want is your team scrambling to figure out who’s in charge. That’s precious time wasted. A risk without an owner is a risk being ignored.

Assign a specific person as the risk owner for every item in your register. They're on the hook for keeping an eye on it, reporting its status, and kicking off the mitigation steps when needed. This one simple move dramatically boosts your plan's chances of success.

For example, a vague threat like a single negative online review can quietly snowball into a major reputation crisis if no one is assigned to watch it. You can learn more about actively protecting your brand image in our guide to online reputation management tips.

Focusing Only on Catastrophic Risks

It's natural to get fixated on the big, dramatic "black swan" events—the massive data breaches or the once-in-a-century storms. But focusing only on those showstoppers means you're probably ignoring the small, high-probability risks that can slowly bleed your business dry.

These are the "death by a thousand cuts" risks. Think minor equipment failures, consistent little project delays, or a slow trickle of employee turnover. On their own, they seem manageable. But their combined effect can be just as devastating as one big catastrophe.

Make sure your risk identification process looks at the full picture—from the headline-grabbing threats to the small, everyday annoyances. A balanced risk mitigation planning approach addresses the entire spectrum, making sure you’re truly prepared for whatever comes your way.

Got Questions About Risk Mitigation Planning? We've Got Answers.

Even with a solid game plan, a few questions always seem to pop up. Let's tackle some of the most common ones to clear up any lingering confusion and get you feeling confident about your risk mitigation planning.

How Often Should We Actually Review Our Risk Plan?

This is a big one, and the short answer is: probably more often than you think. A risk plan isn't a trophy you dust off once a year; it’s a living document that needs regular attention to stay relevant. For most businesses, a quarterly review is a great starting point.

But that's just the baseline. You should also pull it out anytime a major change is on the horizon. This could be anything from:

- Launching a new product or service

- Expanding into a new market

- A significant shake-up in your industry

- Big internal shifts, like a company restructuring

Think of it like updating the software on your phone. Those regular updates keep it running smoothly and protect you from new threats that have emerged since the last one.

The worst mistake you can make is treating your risk plan as a one-time task. The business world is always in motion, and a plan that's even six months old might already be dangerously out of date.

Is This Whole Process Too Complicated For a Small Business?

Not at all. In fact, you could argue that risk mitigation planning is more critical for small businesses. Larger corporations often have the resources to absorb a surprise hit, but for a smaller company, a single unexpected event can be devastating.

The key is to scale it to your needs. Your risk plan doesn't need to be a 100-page binder filled with complex analytics. It can be as simple as a spreadsheet that tracks your top five to ten biggest risks, who's in charge of watching them, and what you’ll do if they happen. The core process—identify, analyze, plan, and monitor—works just as well for a five-person startup as it does for a Fortune 500 company.

What's The Real Difference Between Risk Management and Risk Mitigation?

It’s easy to get these two mixed up because people often use them interchangeably, but they aren't the same thing.

Think of risk management as the entire playbook. It’s the overarching process of finding, analyzing, prioritizing, and keeping an eye on all potential risks. It’s the whole strategy.

Risk mitigation, on the other hand, is just one specific play from that book. It’s the action you take to lessen a risk’s impact or the chance of it happening—the "control" strategy we talked about earlier. Simply put, mitigation is a response that lives inside your larger management framework.

Ready to make your professional voice heard? RedactAI helps you create compelling LinkedIn content that reflects your unique expertise and builds your brand. Stop staring at a blank screen and start crafting posts that connect. Discover how RedactAI can elevate your LinkedIn presence today.